Managing information in a law firm – How to get it right!

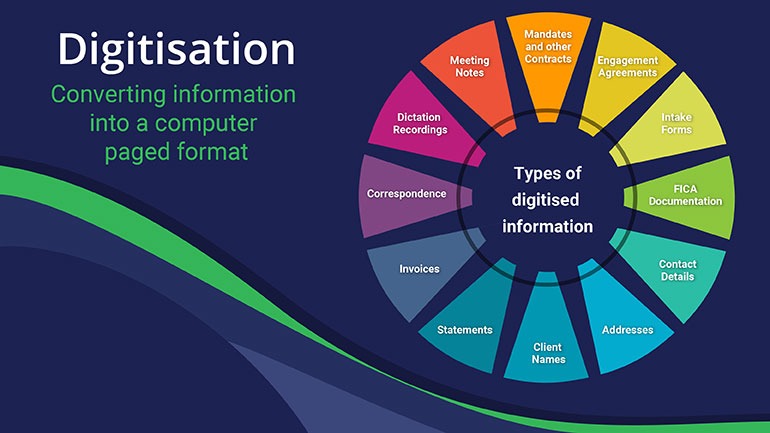

There is a lot of talk about ‘digitisation’ in the ether at the moment. For those of us who are not tech savvy the term can be confusing because it is so vast and encompassing. Many feel that as long as our documents are being saved onto a server, we have digitized the firm. This is however, so far from the real intention of the term and merely the first step.

Digitisation refers to converting information into a computer-based format. Its purpose is to aid the control and organisation of information through technology, to provide efficiencies and storage cost savings. One of the desired outcomes from any move to a digital format should be to provide effective use of the information to feed strategic decision-making.

When dealing with information consideration needs to be given to how it is collected and stored, how it is organised and protected, its accuracy and how it can be utilised and analysed to gain insights into operations.

There are some inherent obligations which come with the collection and retention of data or information, which stem from GDPR, POPI and industry specific legislation. Any risks of contravening these requirements need to be considered and appropriate mitigation put in place, including those required to validate the destruction of data.

Types of Information

We are not always aware of all the information we gather and use in our normal daily activities. This may include, but is not limited to

- Client Names

- Addresses

- Contact Details

- FICA Documentation

- Intake Forms

- Engagement Agreements

- Mandates and other Contracts

- Meeting Notes

- Dictation Recordings

- Correspondence

- Invoices

- Statements

Traditionally all this information was kept in paper files, and it just stayed there gathering dust. Today however, if this information is kept in a digital form, it can be used to improve customer relationships and drive new engagements and client growth.

The biggest issue with the information we hold, is that most of it is held in an unstructured way across multiple systems and it can become difficult to track appropriately govern its use. The POPI and FIC Acts have made us all aware of concepts like ‘data subjects’ and ‘data protection officers’ and have also highlighted the need for privacy, quality, and sovereignty over the information we hold. When employing systems to assist in the managing of this data, consideration needs to be given to ensure all of these requirements are addressed to ensure that the risk of the data being accessed by unauthorised persons is mitigated.

I attended a webinar earlier this week which just looked at the client intake process and the importance of the customer experience and communication during this period. Because this is seen as such an important first step, there are software offerings which just focus on this part of the client relationship. Whilst it may seem like overkill to have a software solution for this process alone, there are more comprehensive practice management systems that take an overall view of information management.

Systems that can help

There are a variety of systems that can help with organising data, but just having a folder system of documents achieves only the same as a paper file system. Data cannot easily be extracted from this and used for building customer relationships or understanding how your firm is performing. It also does not mitigate risks in any considerable way, i.e., there is no way of validating that you have received all the clients FICA document, for example.

The appropriate system or systems to employ will depend on what you want to track. There are various legal project management tools that are now available. Lawyers have never really thought of their matters as projects, but the efficiency and improvements in the quality of outcomes for clients can be greatly improved when matters are managed in this way.

- Get an overview of where each matter is at any time

- Task and track your team members

- Each team member was met by a dashboard showing what they need to get done and what is outstanding from previous days, every morning

- All documents, emails, notes, appointments, issues, etc. were retained in a single place, categorised and annotated, giving a single source of truth

- Review actual timeframes against project / process deliverable timeframes

- Document creation / collaboration and versioning using approved templates and precedents

- Legal spend analysis to ensure returns on your investment

In order to gain insight from the matter and financial data within your firm, it needs to be transformed and visualized in a way that it becomes useful. As previously mentioned, a comprehensive practice management system enables this. These systems not only keep documents, notes and the like in an organised way on each client or matter, but with the financial data relating to the matter in the same collection, can provide a great deal of opportunity for analysis whilst ensuring data security and access control.

- Number of new clients / matters per practice area

- Clients with outstanding FICA documentation

- Revenue vs Contribution per practice area / team member

- Performance against budgets per practice area / overall firm

- Team member performance against time and value targets

- Supplier spend and who has to be paid when and how much

You may argue that you already achieve some of this, but how much time is your senior financial staff investing to prepare this for you?

Legal Interact has been providing tech solutions to the legal community in Africa for over 40 years. We have developed our Matter Manager solution as a legal project management tool and Practice Manger Pro as a full practice management solution. We are well placed to assist you on your digitisation journey with expert knowledge of legal operations and the challenges legal firms face in getting their software solution stack right.

Call us on +27 11 719 2000 or email us on in**@***********ct.com today to partner you on your digitisation journey and get insight from the data you already hold and continue to gather.

‘Consumer data will be the biggest differentiator in the next two to three years. Whoever unlocks the reams of data and uses it strategically will win. ‘

Angela Ahrendis Senior Vice President of retail at Apple Inc.