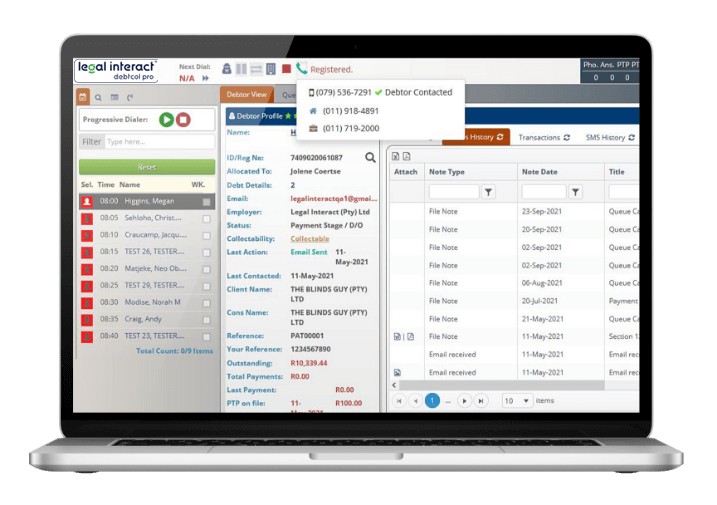

Debtcol Pro

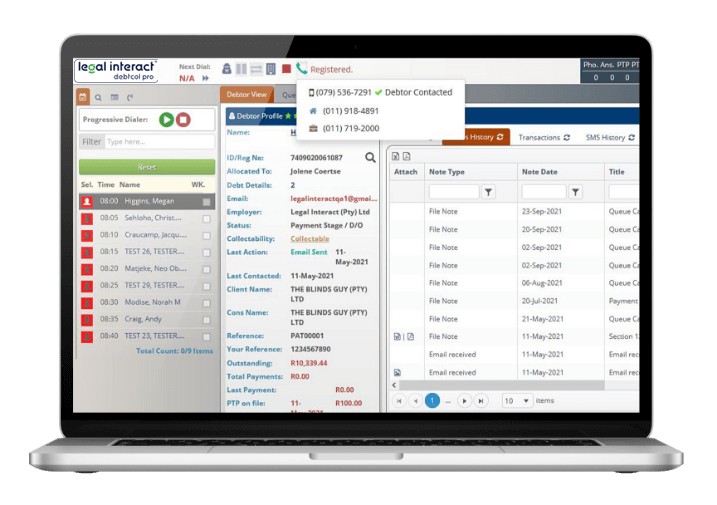

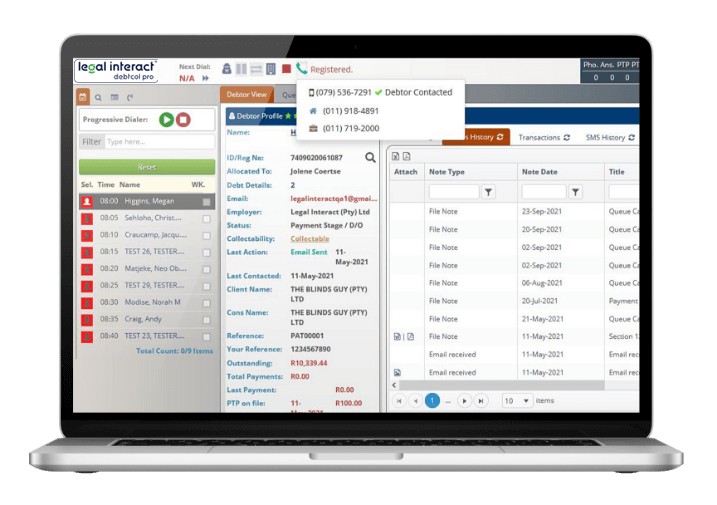

Increase your successful collection probability with smart collections. Debtcol Pro can easily be configured to follow your strategy and therefore maximize your collections. Key to a successful collection business, is the ability to have a collection strategy that can be adapted to the ever-changing requirements of the market and different types of debt.

Debtcol Pro

Increase your probability with smart collections. Debtcol Pro can easily be configured to follow your strategy and therefore maximize your collections. Key to a successful collection business, is the ability to have a collection strategy that can be adapted to the ever-changing requirements of the market and different types of debt.

Book an introduction meeting with one of our Legal Interact experts

Our areas of focus

Profitability &

Compliancy

Simplicity,

Efficiency &

Productivity

Automation &

Billing

Business

Intelligence

Our areas of focus

Profitability &

Compliancy

Simplicity,

Efficiency &

Productivity

Automation &

Billing

Business

Intelligence

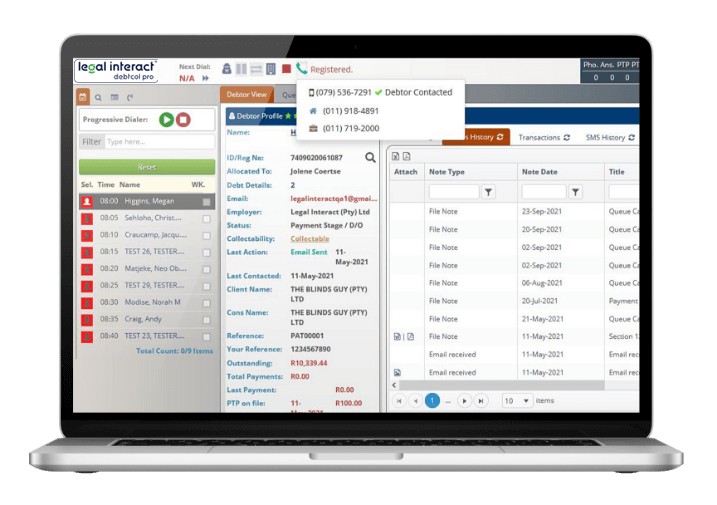

Call Centre Collections

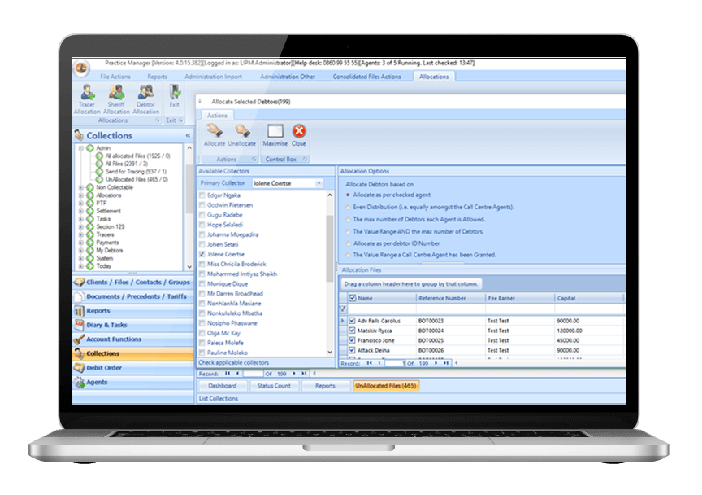

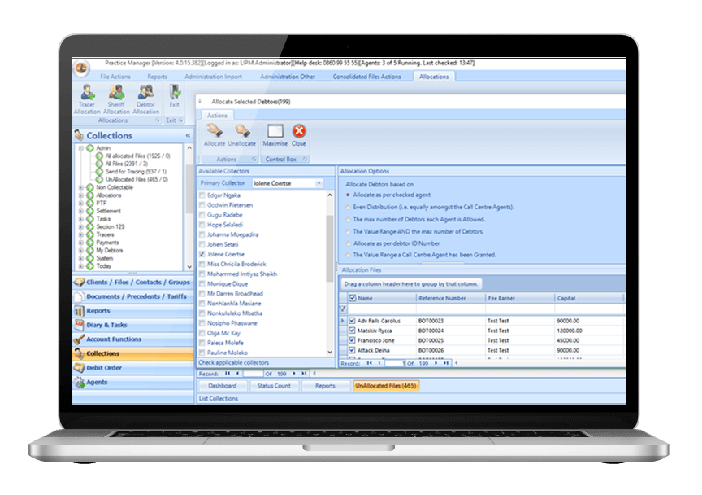

Debtor Allocations

Debtor Allocations

API Integration

Comprehensive API allowing for integration with 3rd Party Software Vendors

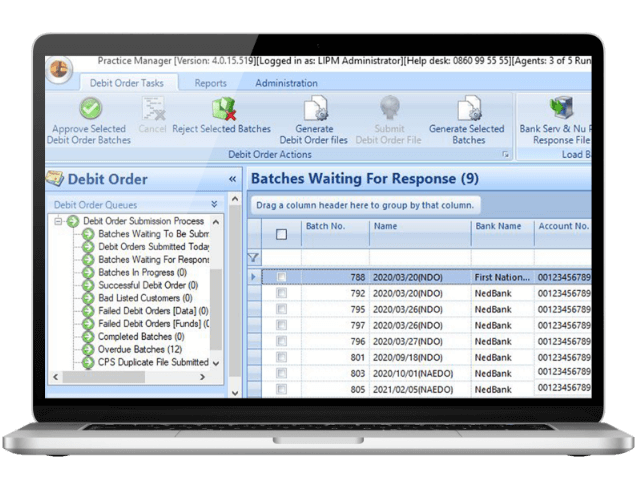

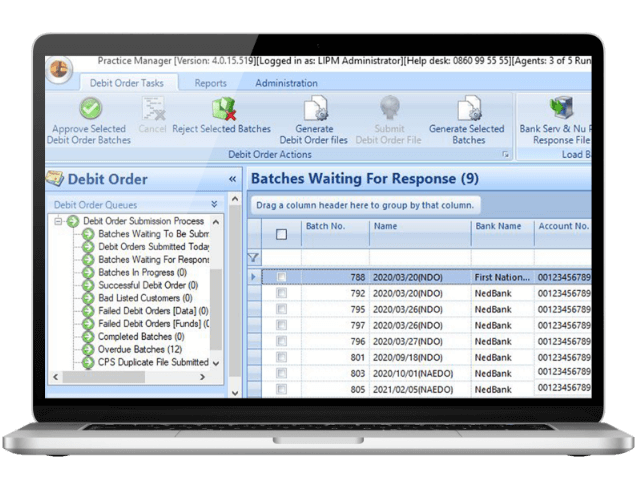

Debit Orders

All payment plans can be collected by debit order using the debit order module. The system caters for both NAEDO and ACB debit orders.

Debit Orders

All payment plans can be collected by debit order using the debit order module. The system caters for both NAEDO and ACB debit orders.

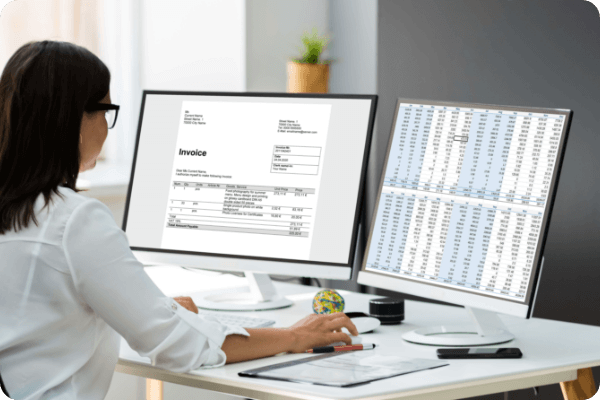

Reporting

Customisable grids make reporting to your clients easy. There is no need for programmers to set up reports. All grids can be exported to Excel depending on the user permission. Standard set of reports included to provide insight into the Agent Activity on a daily/weekly/monthly basis that can be accessed at any time and also e-mailed to a Supervisor/ Manager on specific days and times.

Reporting

Customisable grids make reporting to your clients easy. There is no need for programmers to set up reports. All grids can be exported to Excel depending on the user permission. Standard set of reports included to provide insight into the Agent Activity on a daily/weekly/monthly basis that can be accessed at any time and also e-mailed to a Supervisor/ Manager on specific days and times.

Automated Processes

Pre-configured SMS/Emails can automatically be generated in bulk when certain events in the workflow occur. These automated messages are then also automatically billed to the debtor. An escalation process can be set up to send another automated message after a certain period of time elapsed.

Automated Processes

Pre-configured SMS/Emails can automatically be generated in bulk when certain events in the workflow occur. These automated messages are then also automatically billed to the debtor. An escalation process can be set up to send another automated message after a certain period of time elapsed.

Customise your workflow

Queues are populated with debtors on the occurrence of certain predefined actions. Collection agents/Legal Secretaries monitor debtors only in their queues. Queues are only cleared once the required action has been completed within the system. A mere tick will not suffice.

Customise your workflow

Queues are populated with debtors on the occurrence of certain predefined actions. Collection agents/Legal Secretaries monitor debtors only in their queues. Queues are only cleared once the required action has been completed within the system. A mere tick will not suffice.

Agent Allocation

Debtors can be manually or auto allocated to collection agents/legal secretaries by number of handovers, round robin or according to value. Users can only see debtors allocated to them to ensure complete focus on specific tasks.

Agent Allocation

Debtors can be manually or auto allocated to collection agents/legal secretaries by number of handovers, round robin or according to value. Users can only see debtors allocated to them to ensure complete focus on specific tasks.

Outlook Integration

The system uses Microsoft Outlook integration from where the user can access incoming emails directly from within the Debtcol Pro software.

Outlook Integration

The system uses Microsoft Outlook integration from where the user can access incoming emails directly from within the Debtcol Pro software.

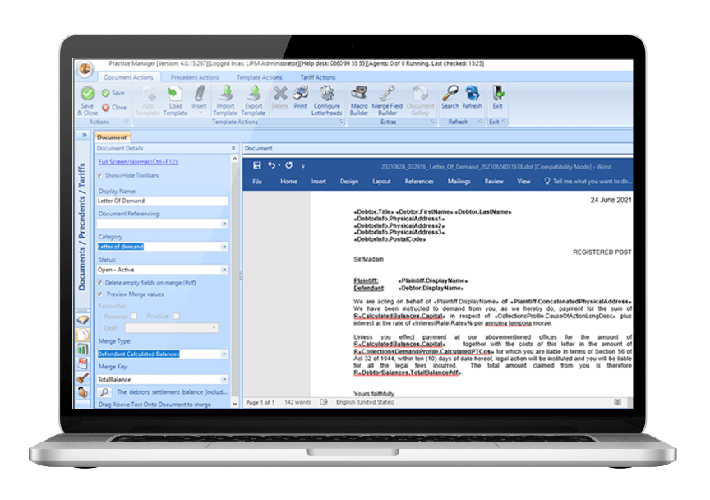

Templates

A standard set of documents is provided that can be customised to specific requirements. All fields including “customised” user added fields can be merged into documents. The templates can be easily maintained and updated by the user at any time. There is no limit on the number of templates that can be created in the system.

Templates

A standard set of documents is provided that can be customised to specific requirements. All fields including “customised” user added fields can be merged into documents. The templates can be easily maintained and updated by the user at any time. There is no limit on the number of templates that can be created in the system.

Contacting the Debtor (Web)

SMS/Email can be automatically sent on import to alert the debtor that the matter has been handed over for collection. By using the SMS/Email templates, automated messages can be pre-configured and sent to the debtor as a reminder to pay when PTP’s are breached. There is no need to manually extract debtor information and upload it to third party software. All SMS/Emails are stored against the debtor record (history). The SMS replies are automatically stored against the debtor record. SMS/Emails can be sent singularly or in bulk as well as manual or automated directly from the system.

Contacting the Debtor (Web)

SMS/Email can be automatically sent on import to alert the debtor that the matter has been handed over for collection. By using the SMS/Email templates, automated messages can be pre-configured and sent to the debtor as a reminder to pay when PTP’s are breached. There is no need to manually extract debtor information and upload it to third party software. All SMS/Emails are stored against the debtor record (history). The SMS replies are automatically stored against the debtor record. SMS/Emails can be sent singularly or in bulk as well as manual or automated directly from the system.

Payment Arrangements & methods (Web)

Weekly, monthly and once-off payments or a combination thereof are catered for. Expected interest and charges are calculated over the period of the plan. The payment plan can be merged into an agreement and sent to the debtor for acceptance and signature. An automated SMS/email to remind the debtor to make payment can be sent

Payment Arrangements & methods (Web)

Weekly, monthly and once-off payments or a combination thereof are catered for. Expected interest and charges are calculated over the period of the plan. The payment plan can be merged into an agreement and sent to the debtor for acceptance and signature. An automated SMS/email to remind the debtor to make payment can be sent

Legal Collections

Billing Debtor & Clients

Charges/tariffs can be automatically or manually recorded on the file as actions are performed keeping the debtor balance up to date. Our integrated account software allows for printing client invoices and statements with full accounting functionality.

Billing Debtor & Clients

Charges/tariffs can be automatically or manually recorded on the file as actions are performed keeping the debtor balance up to date. Our integrated account software allows for printing client invoices and statements with full accounting functionality.

Legal processes and documents

The Legal processes are also managed via queues and customised using the Queue Builder. Documents are generated using client and debtor information. Pertinent dates including: generated, served, issued, court dates are recorded. Queues can be established for documents not timeously returned so that they can be followed up. All documents are stored electronically on the debtor file for easy retrieval. Comprehensive reporting can be created to indicate the current legal status of the debtor file.

Legal processes and documents

The Legal processes are also managed via queues and customised using the Queue Builder. Documents are generated using client and debtor information. Pertinent dates including: generated, served, issued, court dates are recorded. Queues can be established for documents not timeously returned so that they can be followed up. All documents are stored electronically on the debtor file for easy retrieval. Comprehensive reporting can be created to indicate the current legal status of the debtor file.

Payment Arrangements & methods

Payment plans can be calculated to settlement or for a specified number of payments. Multiple payment plans can be created and compared using different payment amounts and periods. This can be used as an effective negotiation method by providing insight into the saving on interest and reduction of instalments if paying an additional amount per month. All payment plans can be collected by Debit order, Easypay or EFT. These payments can be imported to ensure the debtor’s balance is kept up to date. The system also caters for a “grace period” that can be configured to specific payment types.

Payment Arrangements & methods

Payment plans can be calculated to settlement or for a specified number of payments. Multiple payment plans can be created and compared using different payment amounts and periods. This can be used as an effective negotiation method by providing insight into the saving on interest and reduction of instalments if paying an additional amount per month. All payment plans can be collected by Debit order, Easypay or EFT. These payments can be imported to ensure the debtor’s balance is kept up to date. The system also caters for a “grace period” that can be configured to specific payment types.

Contacting the Debtor

When contacting the debtor, indicate the method and latest contact information to be used for future contact. SMS/Email can be automatically sent on import to alert the debtor that the matter has been handed over for collection. By using the SMS/Email templates, automated messages can be pre-configured and sent to the debtor as a reminder to pay when PTP’s are breached. There is no need to manually extract debtor information and upload it to third party software. All SMS/Emails are stored against the debtor record (history). The SMS replies are automatically stored against the debtor record. SMS/Emails can be sent singularly or in bulk as well as manual or automated directly from the system

Contacting the Debtor

When contacting the debtor, indicate the method and latest contact information to be used for future contact. SMS/Email can be automatically sent on import to alert the debtor that the matter has been handed over for collection. By using the SMS/Email templates, automated messages can be pre-configured and sent to the debtor as a reminder to pay when PTP’s are breached. There is no need to manually extract debtor information and upload it to third party software. All SMS/Emails are stored against the debtor record (history). The SMS replies are automatically stored against the debtor record. SMS/Emails can be sent singularly or in bulk as well as manual or automated directly from the system

Efficiency in your practice

Manual and automated charges together with full accounting functionality ensures that you will bill and recover all disbursements and fees.

Cloud Hosted PABX

Allow your Call Centre to make calls from anywhere with a cloud-hosted PBX

- Online access to Debtcol from any location

- Greater reliability, average “Cloud” up time of 99.97%

- Freedom from responsibility of server ownership

- Encrypted data protection

- No capital expenditure

- Reduced costs for travel

Cloud Hosted PABX

Allow your Call Centre to make calls from anywhere with a cloud-hosted PBX

- Online access to Debtcol from any location

- Greater reliability, average “Cloud” up time of 99.97%

- Freedom from responsibility of server ownership

- Encrypted data protection

- No capital expenditure

- Reduced costs for travel

Ready to see more?

We would like to show you in real-time, how our software can improve the efficiency and the operation of your business. Book a demo with us for a convenient date and time.